Flights are becoming scarcer and air freight costs are soaring. Ships are blocked in Chinese ports (50% of departures are cancelled), a railway line is interrupted between Wuhan, China, and Dourges (Pas-de-Calais), which is causing great problems to Decathlon... The supply chain will be the first economic victim of the coronavirus in the coming weeks. If the epidemic turns into a pandemic for several months, all supplies from the world's factories will be severely disrupted.

.png)

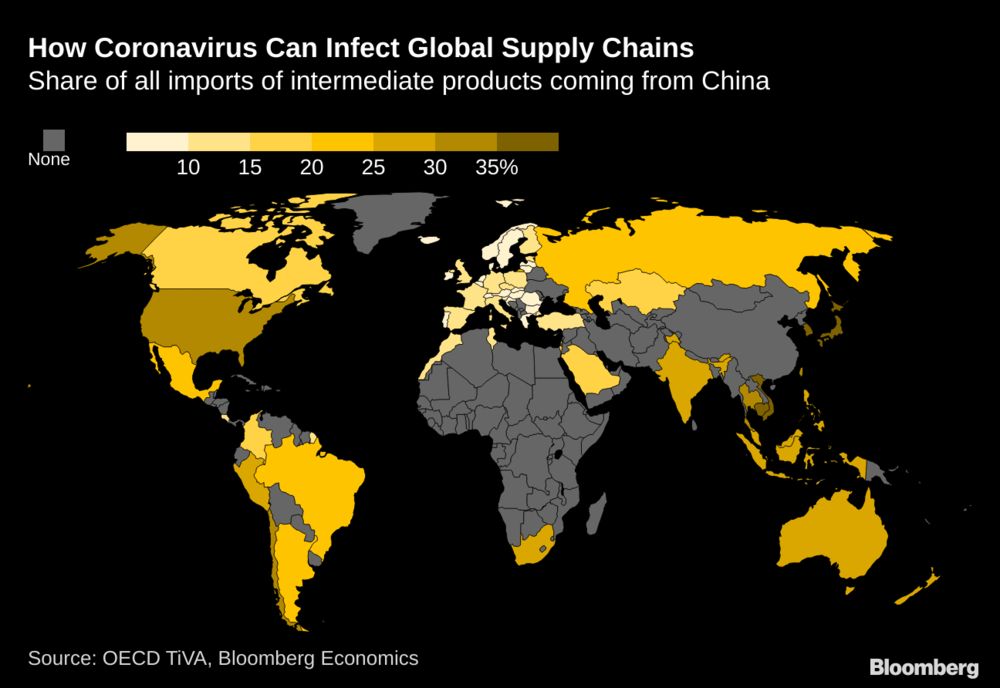

While the impact on the Chinese economy is real, the impact on the global economy is significant. In this globalized world, major brands outsource all or part of their production and often assemble components that were previously manufactured anywhere in the world. Components sold by suppliers that may be lacking at the first sign of supply problems.

1) The drop in demand in China, particularly in Retail / FMCG where up to 80% drop in sales can be observed in some cities. It is estimated that the impact on GDP is between $30 and $100 billion in China.

2) Delays in delivery of components and finished products from our suppliers in China & Asia.

As you can see on the map below, supply chain is extremely dependent on China. Companies such as Apple, Samsung, Amazon announce delays ranging from 7 days to 1 month. Not to mention the congestion on sea and air freight at the end of this crisis.

Here is a simple action plan you can follow to better prepare your company to deal with this crisis.

• Revise your short-term forecasts as soon as possible, by city and region.

• Your sales' volatility & uncertainties will be very important in the coming months, concentrate on guaranteeing the availability of your products (20/80) and strongly reduce your stock coverage on products with low sales uncertainty.

• If you have automatic replenishments using past average sales, increase the duration of this average sale to limit the "YoYo" effect of volatility. For example, if you had an average sale over the last 7 days, switch for example to 28 days until the end of the crisis.

• Think about correcting your sales history and seasonality so that you don't break next year with double-digit growth (especially in ERPs such as SAP or Oracle).

• Get maximum visibility from your suppliers

• Increase your lead times for suppliers impacted in your ERP/MRP (at least 2 weeks on products impacted in China).

• Increase your safety stock on your products 20/80 permanent

• Reduce/remove promotions on at-risk products to limit stock shortage and maximize your profits.

• Centralize your stocks in a minimum number of storage points to better manage shortages.

• In case of a shortage, give maximum priority to your biggest customers (20/80) and offer substitute products.

• Ask for a weekly report from your teams & suppliers and be reactive to the slightest change in trend.

• Don't forget to be proactive and transparent in your communications with your Marketing, Sales, Finance & Customer teams. It's times like these that you have to use your leadership and show that you are taking this challenge seriously.

For retailers, the virus could have multiple effects. They could face supply chain disruption and traffic decrease in shopping centers, they also are sources of disease-fighting essentials that consumers are over-stockpiling.

The first step of this situation is that point of sales will have a risk of being looted. Then, with such uncertainty, many people are hesitant about gathering in crowded public spaces, and that is hurting traffic to physical retailers, especially in malls.

Brick-and-mortar retailers and restaurants are dealing with the harsh realities of cities across China being placed under lockdown, as local governments enforce quarantine measures and restrict trips outdoors. Major retailers had temporarily shuttered their stores, while small and medium-size retailers are being hit particularly hard as foot traffic dwindles.

We advise retailers to take health measures with best practices for avoiding the infection spread. We also advise them to boost and promote their e-commerce website in order to meet the demand.

The big losers are the luxury industry players, they haven’t fully embraced e-commerce. Pauline Brown, a former chairwoman at LVMH North America, says that luxury shopping is “a psychological purchase,” and she rightly states that when “people are not feeling safe,” they aren’t eager to shop. Given the current paranoia, it’s unthinkable that Chinese consumers will return to their normal purchasing habits. In this case, it could be a great opportunity for them to rethink and promote their online business model.

To minimize human-to-human contact in e-commerce delivery, companies such as Meituan and JD.com are experimenting end-to-end “contactless” solutions using unmanned vehicles and drones. Some hospitals are also using robots to guide patrons or transport medical supplies within their facilities. This could potentially be an area of opportunity for companies looking to develop technology that aims to automate tasks.

Companies still have gaps in mapping their supply chain. 65% of companies do not have a mapping of their supply chain. 55% do not know the precise location of their suppliers' production sites. And 70% do not know their Tier 2 suppliers. A large number of companies depend on the Chinese market for both raw materials and finished products. Anticipating supply chain risks and knowing how to respond to them is essential.

It is hard to anticipate the arrival of global crises such as the coronavirus outbreak, but companies can mitigate their impacts by taking supply chain readiness to a higher level. They should act before a disruption occurs and adjust and execute new plans afterward rather than starting from scratch every time they are plunged into a new crisis.

Don’t lose this opportunity to participate to the most impactful retail and e-commerce event of 2020.

Insights on how COVID-19 is affecting Supply Chain & Logistics and how retailers can become more resilient to survive or even gain market shares.

Read more.jpg)

One of the world's leading retail events took place for 3 days in New York City. What to expect ? What were the topics discussed during this global retail pilgrimage ?

Read more

Any company wishing to participate to a hackathon must therefore consider the long-term follow-up of ideas and projects and not limit its investment to the 2 days of the event.

Read more